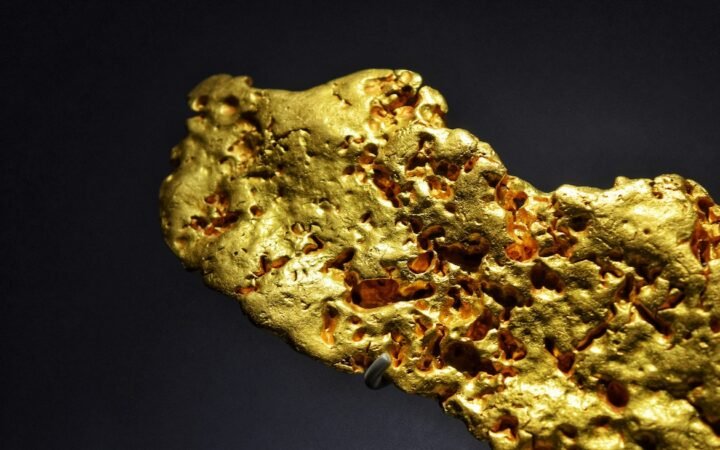

Gold Overtakes U.S. Dollar as World’s Largest Reserve Asset

Gold has surpassed the U.S. dollar to become the world’s largest reserve asset as the dollar continues to weaken. Markets are increasingly favoring real assets amid rising concerns over holding cash.