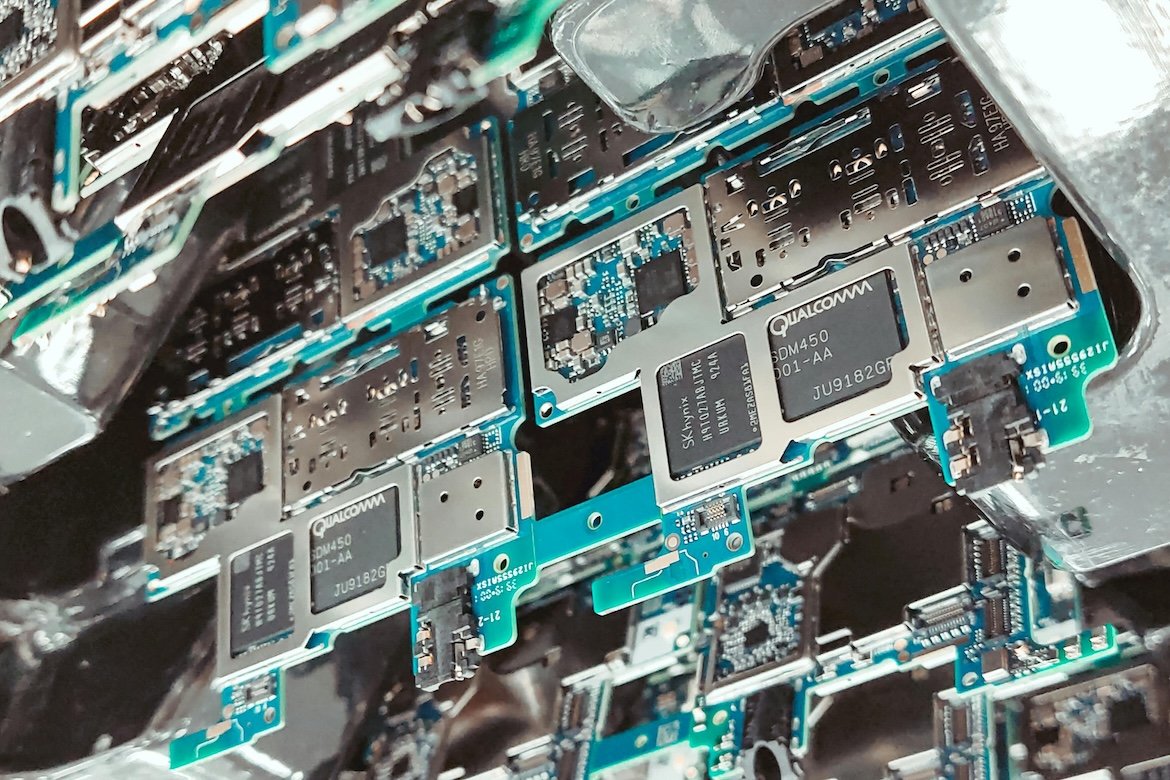

Qualcomm is making a major strategic leap, announcing two forthcoming data-center chips the AI200 and AI250 which mark its move beyond traditional mobile semiconductors into the booming AI infrastructure market.

The AI200 is slated for release in 2026, followed by the more advanced AI250 in 2027, positioning Qualcomm to compete directly against heavyweights Nvidia and AMD. Shares shot up in early trade, reflecting investor excitement about the opportunity to tap generative-AI and inference growth.

Why Qualcomm’s Move Matters

Qualcomm’s new chips are designed specifically for AI inference workloads the rapid, large-scale use of pre-trained AI modelsrather than model training. This focus targets the high-volume demand for compute power in cloud and enterprise settings.

The AI200 and AI250 systems boast technical features aimed at cost and performance leadership: memory configurations of up to 768 GB per accelerator card, improved memory bandwidth and energy efficiency compared with legacy GPU architectures. By building full rack-scale solutions (cards plus accelerator racks), Qualcomm aims to deliver a lower total cost of ownership for enterprise customers.

Importantly, the move signals that Qualcomm is shifting from smartphone-centric chips to infrastructure-scale AI hardware a strategic reorientation driven by escalating demand for generative-AI compute. The company has also partnered with a major customer to deploy hundreds of megawatts of AI hardware starting in 2026, underscoring commitment to execution.

Implications, Risks & What to Watch

For the semiconductor sector, Qualcomm’s entry intensifies competition in an arena long dominated by Nvidia and AMD. If Qualcomm captures meaningful share, incumbent valuations may be challenged and pricing pressure could emerge across AI-hardware stacks.

However, execution risks are high. Delivering at rack scale, achieving software and framework compatibility, and securing customer contracts are all complex. Delays or design mis-steps would raise questions about Qualcomm’s ability to pivot effectively. Additionally, macro-economic risks higher costs, supply-chain tensions and slower enterprise spending could dampen demand for new infrastructure.

Key indicators to monitor include benchmark performance of the AI200/AI250 chips, initial customer roll-outs, pricing and margin visibility, and how quickly Qualcomm scales its server-hardware ecosystem. Also critical: how Nvidia and AMD respond whether via price cuts, feature upgrades or strategic alliances.

As previously covered, the shift of major tech players into data-center AI hardware marks the next frontier of competition and scale. Qualcomm’s ambitious entry is a major signal but the proof will be in delivery.