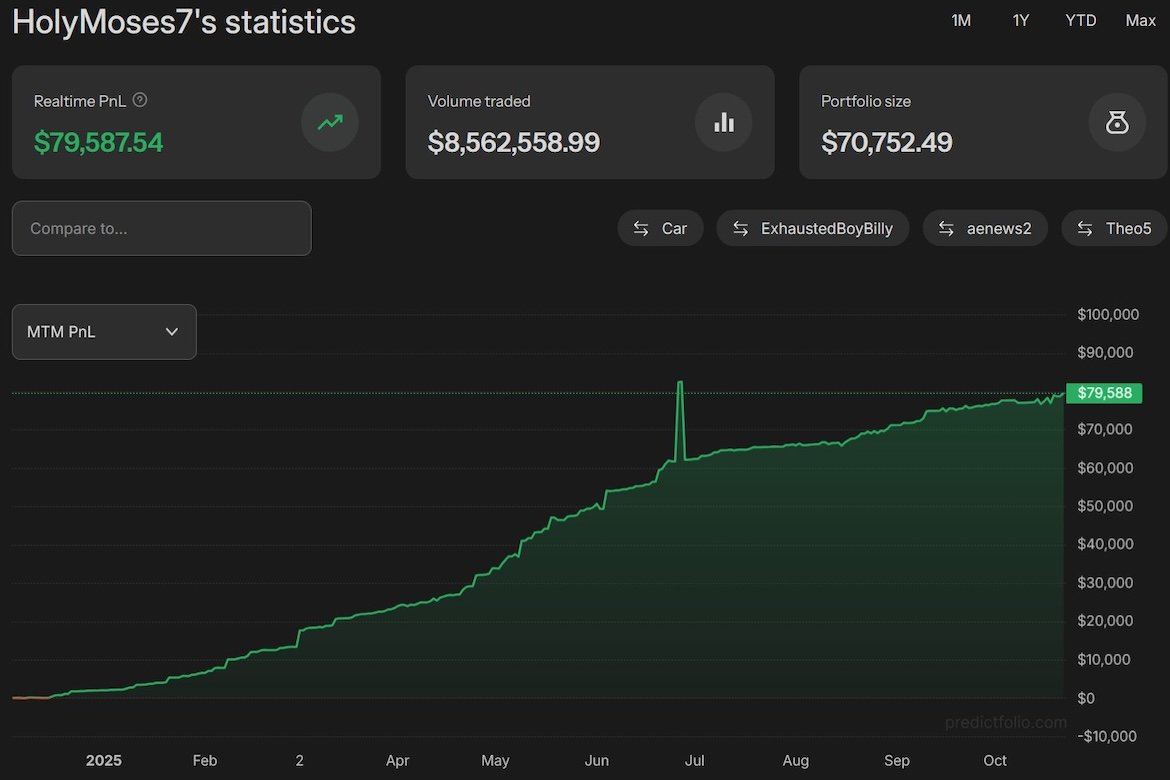

A retail trader active on the blockchain-based prediction platform Polymarket says they have turned an initial $1 investment into more than $80,000 in just one year. Posting under the handle Holy Moses, the trader shared their results and strategy, outlining how a mix of focus, volatility, and persistence transformed a small test wager into a full-scale trading operation.

From $1 to over $80k in a year. This is my @Polymarket journey.

My journey in started a couple of days prior to US elections with a single dollar. I focused on volatile polymarkets including the Balance of Power and Trump rallies which had tons of liquidity and volume. In a few… pic.twitter.com/uLjfPNAZ6P

— Moses (@holy_moses7) October 22, 2025

According to the trader, their journey began just before the U.S. elections, starting with modest bets on high-liquidity markets such as Balance of Power outcomes and Trump rally participation. Within days of the election, those positions had multiplied several hundredfold as trading activity surged.

Inside the Strategy

The trader explained that they focused on high-volume, fast-moving markets where liquidity enabled active speculation and short-term exits. Their approach evolved to include global elections, geopolitical outcomes, and even pop-culture topics like the frequency of Elon Musk’s social media posts.

Over time, the trader reported monthly profits averaging between $6,000 and $7,000, with the majority of gains coming from election-based markets. According to their own remarks, the key to success was combining event research, sentiment tracking, and risk control rather than relying on chance.

They described the path as “the road from $1 to $1 million,” acknowledging that while the goal remains aspirational, consistent discipline and market understanding make it feasible. “It’ll take time, but I’m persistent,” the trader noted.

Prediction Markets and Industry Impact

Polymarket, a blockchain-powered prediction platform, has grown rapidly over the past year, with users speculating on everything from global politics to macroeconomic trends. The platform’s popularity illustrates how decentralized prediction markets are becoming a new frontier for data-based speculation, enabling retail traders to profit from real-world events.

However, the rise of event markets also highlights broader debates over regulation, transparency, and market integrity. Analysts caution that while outsized returns are possible, most users face steep learning curves and volatility risks.

Prediction markets sit at the crossroads of finance, gaming, and analytics – blending probability trading with crowd forecasting. Stories like this one underline both their profit potential and inherent risk, showing how innovation continues to blur the line between investing and speculation.