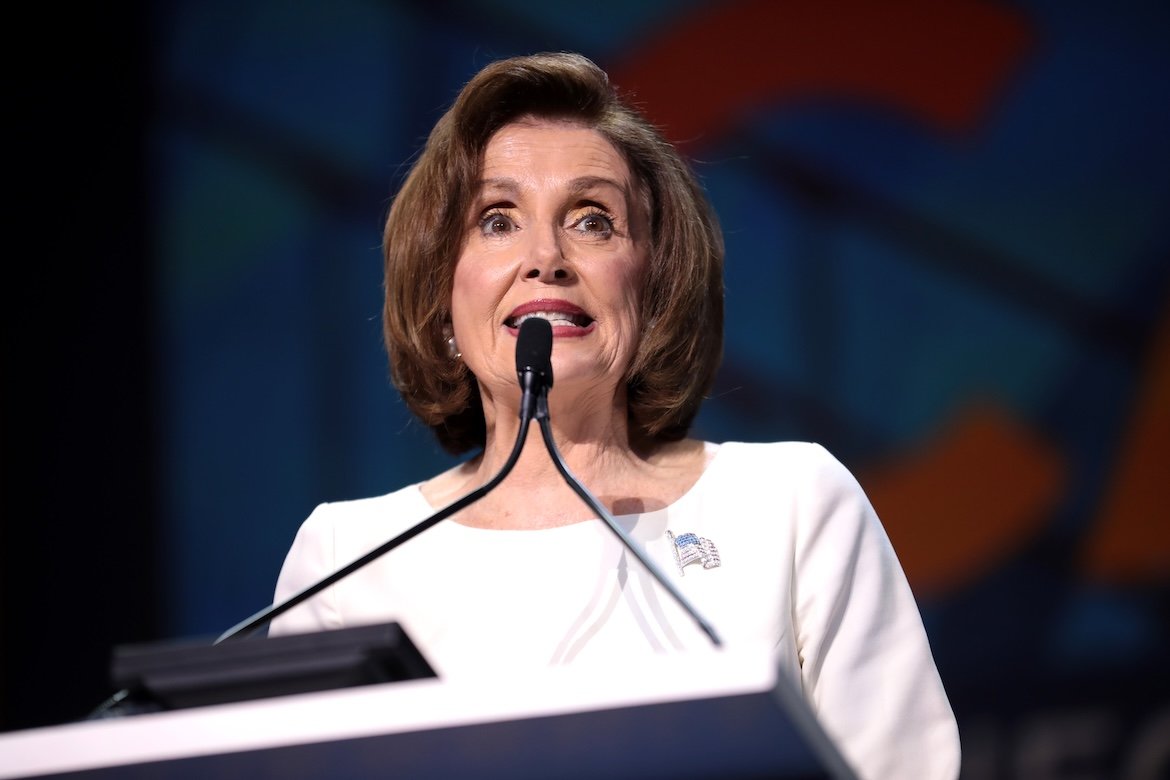

Nancy Pelosi has carried out a significant restructuring of her investment portfolio, sharply increasing her use of options while reducing direct equity exposure across several major technology companies. The changes, disclosed in recent filings, show a clear shift toward long-dated call options and strategic reallocation among leading U.S. stocks.

The moves span some of the largest names in the technology sector, including Alphabet, Amazon, Apple, and Nvidia. The restructuring also includes sales and option exercises in several non-tech holdings, underscoring a broad repositioning rather than isolated trades.

Why Pelosi is leaning into options

In Alphabet, Pelosi exercised 50 call options with a $150 strike price, adding 5,000 shares, while simultaneously purchasing 20 additional $150 call options expiring on January 15, 2027. At the same time, 7,704 Alphabet shares were transferred into a donor-advised fund, reducing taxable exposure.

A similar strategy was applied to Amazon. Pelosi exercised 50 call options at a $150 strike price, acquiring 5,000 shares, sold 20,000 shares outright, and purchased 20 new $150 call options with the same January 2027 expiration. The pattern suggests a deliberate replacement of equity holdings with leveraged exposure through options.

Apple saw one of the largest equity reductions. Pelosi sold 45,000 shares and transferred an additional 28,200 shares into a donor-advised fund, while opening 20 call option positions with a $100 strike price expiring in January 2027. The trades significantly lowered direct ownership while preserving upside participation.

In Nvidia, Pelosi exercised 50 call options at an $80 strike price, adding 5,000 shares, sold 20,000 shares, and bought 20 call options at a $100 strike price with a January 2027 expiration. As previously covered, Nvidia has been one of the most closely watched stocks amid the artificial intelligence boom, making the continued exposure notable.

What the portfolio overhaul signals

Beyond Big Tech, Pelosi sold 5,000 shares of PayPal, exercised 50 call options in Tempus AI at a $20 strike price, acquiring 5,000 shares, and exercised 50 call options in Vistra at a $50 strike price. She also sold 10,000 shares of Disney and purchased 25,000 shares of AllianceBernstein.

Additionally, Pelosi received 776 shares of Versant Media along with cash following its separation from Comcast.

For investors, the portfolio overhaul highlights a strategic preference for optionality and leverage rather than outright ownership. Long-dated call options allow exposure to upside while limiting capital at risk, though they also introduce time decay and volatility sensitivity.

The scale and coordination of the trades are likely to attract renewed attention to congressional investing practices. Market participants often scrutinize Pelosi’s disclosures for directional signals, particularly in technology stocks, though analysts caution that options-based strategies can reflect tax planning and portfolio mechanics as much as market conviction.

Taken together, the reshuffle points to a calculated bet on continued strength in select growth stocks, but with risk managed through structure rather than scale.