Archives

21Shares Files HYPE ETF as Bitwise Solana Staking Fund Hits Big Volume

Crypto-focused fund manager 21Shares has filed for an ETF tracking the Hype token, while Bitwise’s Solana staking ETF recorded over $72 million in trading volume on its second day-highlighting growing institutional interest in crypto ETF products.

Swiss-based asset manager 21Shares has filed for regulatory approval in the United States to launch a Hype ETF, an exchange-traded fund designed to track the performance of the Hype token, native to the Hyperliquid ecosystem. The filing names custodians such as Coinbase Custody and BitGo Trust, though the registration does not yet disclose a ticker symbol or fee structure.

Meanwhile, U.S. fund manager Bitwise saw its Solana Staking ETF (BSOL) generate over $72 million in trading volume on its second day—one of the strongest volumes posted by a newly launched crypto ETF in 2025. The debut day of BSOL drew approximately $55.4 million, making it the largest crypto-ETF launch of the year so far.

Market Gateway for Altcoins

The dual news points reflect a widening appetite among institutional and retail investors for crypto investment products that extend beyond Bitcoin and Ethereum. By targeting the Hype token and Solana’s staking mechanisms, fund managers are tapping into emerging sectors such as decentralized finance and tokenised network utility.

21Shares’ move underscores its ambition to push alt-coin ETFs into mainstream investment channels. Bitwise’s strong early volume confirms that investors are willing to commit significant capital to these vehicles at launch – setting a higher bar for crypto-asset funds going forward.

Future Prospects and Key Watchpoints

For investors and asset-managers, the developments suggest that crypto-ETFs are evolving rapidly: they are no longer limited to Bitcoin tracking but now include targeted tokens and staking features. Success will hinge on regulatory approval, token availability, liquidity and how these funds perform relative to underlying assets.

Solana ETFs Launch, Yet SOL Trades Under $200

Despite the debut of spot Solana ETFs and strong institutional inflows, the SOL token remains stuck below $200, highlighting a gap between ETF launch momentum and asset performance.

Several new spot-market exchange-traded funds (ETFs) tied to Solana (SOL) began trading this week, driven by strong backing from institutional investors. However, the underlying SOL token remains stuck below the psychological $200 level, reflecting a disconnect between ETF hype and token price action.

The first launches include the staking-enabled Solana ETFs by major issuers, which together pulled hundreds of millions of dollars in initial asset inflows. Real-time data show notable stake participation and volume in the early days of trading.

ETF Launch Doesn’t Yet Translate Into Token Gain

Analysts note that while institutional interest is clear – staking-enabled and regulated Solana ETFs appeal to large investors – the token’s price is yet to reflect that on-chain momentum. Historical analogues, such as the launches of Bitcoin and Ethereum ETFs, showed minimal immediate upside in prices. In fact, initial token responses were muted or flat despite inflows.

For SOL, technical data illustrate a consolidation phase. The support range sits around $188–$185, while resistance lingers near $204–$207. Additional headwinds include macro uncertainty and event timing: the central-bank meeting this week is prompting many institutional players to reduce risk exposure.

Investor Signals and Future Catalysts

Despite the underperformance of SOL’s price, the ETF launches themselves remain a positive signal for institutional infrastructure. Key areas to monitor include:

- Net inflows and daily volume in the new Solana ETFs.

- Progress in staking activity and whether the ETF-structure drives token lock-up.

- Whether SOL can break out above the resistance zone around $200 with volume support.

- Broader crypto-market sentiment, especially liquidity flows into altcoins and institutional layers.

If ETFs continue to attract assets and staking-lock increases supply pressure, the token could benefit from a delayed response rather than immediate breakout. On the other hand, failure to breach key technical levels or macro shocks could keep SOL in a sideways range or push it lower toward the $180 region.

As previously covered, ETFs are increasingly important gateways for institutional exposure in crypto, but they do not guarantee near-term price gains. SOL’s current phase may be one of foundational infrastructure building rather than immediate price fireworks.

Indonesia’s Digital Rupiah Set to Include Bond-Backed Stablecoin Variant

Indonesia’s central bank plans to launch a stablecoin-style companion to the digital rupiah, backed by government bonds, integrating blockchain into its monetary system.

Indonesia’s central bank, Bank Indonesia (BI), is advancing its digital finance agenda by planning a new instrument it describes as a “national stablecoin version” of its digital rupiah. The proposed variant will be backed by government bonds (SBN) and sit alongside the planned central-bank digital currency (CBDC).

Bank Indonesia Governor Perry Warjiyo announced the initiative during the Indonesia Digital Finance and Economy Festival 2025 in Jakarta. He said the bank will issue digital securities tokenised via the digital rupiah and backed by national bond holdings, effectively creating Indonesia’s version of a fiat-pegged digital asset.

Bridging CBDCs and Stablecoins

The move is significant because it combines three major trends: central-bank digital currencies, stable-coin design and blockchain infrastructure. By linking digital rupiah issuance to SBN bond backing, Indonesia aims to ensure stability and credibility while exploring tokenised payment rails.

While stablecoins are not yet recognised as legal tender in Indonesia, the country’s financial-services regulator has begun overseeing the use of such tokens. Officials have noted that some stablecoins, especially those backed by tangible assets, are being used for hedging and payment flows already.

For emerging-market policymakers, Indonesia’s approach provides a template: a sovereign-backed digital instrument that offers tokenisation benefits without full exposure to crypto volatility.

Implementation Challenges and Future Impact

The digital-rupiah companion may accelerate Indonesia’s payments modernisation and deepen financial-inclusion efforts. If the bond-backed variant delivers as intended, it might attract domestic and international users seeking tokenised rupee settlement and stable-value digital storage.

However, challenges abound. Implementing a tokenised bond structure raises questions around liquidity, redenomination risk, regulatory clarity and cross-border usage. Observers will watch how quickly Bank Indonesia finalises the legal framework, how the tokens are issued and redeemed, and whether the infrastructure connects with private-sector payment networks.

As previously covered, the intersection of CBDCs and tokenised assets is evolving into a key frontier for financial-system innovation – Indonesia’s experiment may offer a case study in how sovereign digital money and asset-backed tokens converge.

OpenAI Lays Groundwork for IPO at Valuation Up to $1 Trillion

OpenAI is preparing for an initial public offering that could value the company at up to $1 trillion, following a major restructuring and as it prepares for massive capital demands.

OpenAI is reportedly moving toward an initial public offering that could value it at up to $1 trillion, according to people familiar with the matter. The company may file with regulators as early as the second half of 2026, although some advisers point to a 2027 listing. The fundraising target is at least $60 billion, and potentially much more.

Central to the plan is a recent restructuring that positioned OpenAI’s non-profit parent- now called the OpenAI Foundation to hold a 26% stake in the for-profit arm, while Microsoft holds about 27%. The changes reduce OpenAI’s dependency on Microsoft and pave the way for broader capital-raising and acquisition strategies.

AI’s Biggest IPO Yet

OpenAI’s move toward a public listing marks a major inflection point in the AI sector. With a revenue run-rate approaching $20 billion by year-end and heavy capital plans for data-centres and infrastructure, going public would give OpenAI access to a far larger financing base and visibility as a tech titan. CEO Sam Altman has described the IPO path as “the most likely” scenario given the scale of the investments required.

The restructuring is particularly noteworthy. By consolidating governance under the non-profit foundation and formalising a firm structure for the for-profit arm, OpenAI has addressed regulatory and investor concerns—opening the door to public markets and institutional governance models.

Investor Implications

For investors, the potential OpenAI IPO signals both an opportunity and a risk. On the upside, the listing could provide exposure to a leading player in generative AI with a trillion-dollar addressable market. On the downside, valuations at this scale assume sustained growth, large capital expenditures and continued innovation – any mis-step could have magnified consequences.

Key signals to monitor include whether OpenAI actually files in 2026, the final size and pricing of the offering, how its infrastructure spend evolves, and how it balances losses and profitability. Also critical: how markets respond to AI valuations more broadly when a flagship player crosses into the public-market domain.

As previously covered, AI has moved from niche research to infrastructure-scale investment. OpenAI’s successful transition into public markets could redefine how the next generation of tech giants are built and funded.

Fed Cuts Interest Rates Again as Shutdown Clouds Economic Outlook

The Federal Reserve lowered its benchmark interest rate by 25 basis points to a range of 3.75%-4.00%, marking the second consecutive cut this year as economic uncertainty deepens amid a prolonged government shutdown.

The Federal Reserve trimmed its key federal-funds rate by 25 basis points, lowering the target range to 3.75%-4.00%. This marks the second straight meeting in which the Fed has eased policy this year, highlighting growing concern about the economic backdrop amid a U.S. government shutdown and faltering job-market signals.

Despite the cut, the vote was not unanimous. Two Fed officials dissented – one favouring a deeper 50-basis-point reduction and another preferring no change – underscoring divisions within the central bank on how to balance inflation and employment risks.

Why the Fed Acted

With key labour-market data delayed due to the shutdown, the Fed faced significant information gaps. Available indicators pointed to softer hiring and tighter labour supply, prompting policymakers to shift focus from price stability to employment risks. One official commented that the central bank’s biggest “single tool” must now manage both inflation and weak labour trends – an increasingly difficult mandate.

Persistent inflation remains a concern; the latest data show consumer-price increases of around 3% year-on-year. Yet the Fed appears more worried about growth cooling, given that retail sales, manufacturing output and hiring all exhibited signs of deceleration. The rate cut reflects the Fed’s pivot to a cautious easing stance while keeping future options open.

Market Reaction and Policy Outlook

Investors are now pricing in one or two additional rate cuts this year, yet the Fed’s guidance remains cautious. Markets will closely monitor upcoming data for help: the next labour-market report, inflation reads and GDP figures will all influence the Fed’s decision-making.

Key risks include a rebound in inflation – especially if wage pressures resurface or a resurgence of growth that forces the Fed to pause. Meanwhile, the ongoing shutdown continues to hamper data collection, mudding policy signals. Stakeholders will also pay attention to forward guidance for quantitative-easing operations and the balance-sheet trajectory.

As previously covered, the current setting illustrates a shift in central-bank strategy: from inflation-fighting to growth-supportive, but with persistent uncertainty and no clear path ahead.

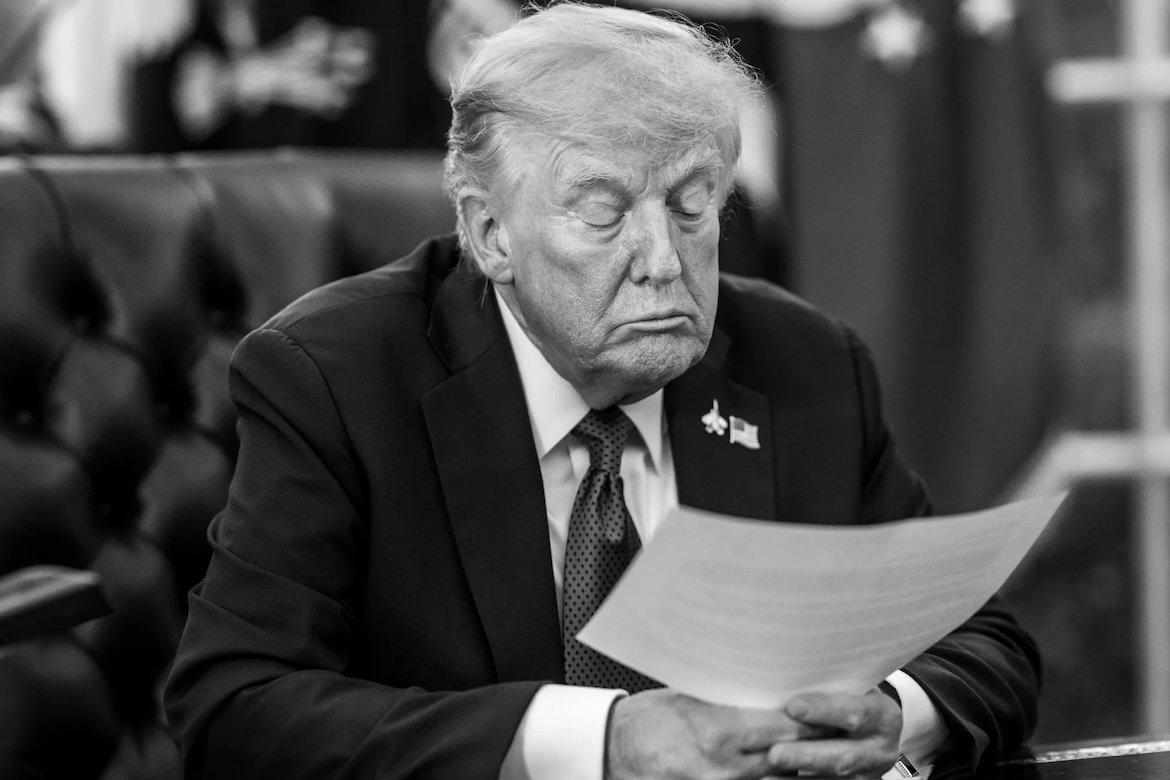

Trump Family’s Crypto Boom Spurs Conflict of Interest Questions

An investigation reveals the Trump family earned nearly $864 million in crypto-related ventures during the first half of 2025, raising ethics concerns amid links to foreign investors and regulated markets.

A detailed investigation has found that the Donald Trump family, led by his sons Eric Trump and Donald Trump Jr., has made about $864 million in crypto-asset revenues during the first half of 2025. The bulk of this amount – over $802 million – came from token sales linked to their firm World Liberty Financial, including its governance token and a Trump-branded meme coin.

Launched in 2024, World Liberty sold governance tokens (WLFI) and a meme coin ($TRUMP) despite lacking a working product. Token-sale proceeds were heavily marketed to foreign investors who sought access to the Trump brand and its perceived influence. Even though the venture is technically lawful, ethics experts say it blurs the line between public office and private gain.

Token Sales Surge Amid Name Power

The family’s meteoric crypto earnings illustrate how branding and political proximity can dominate over utility in digital-asset markets. A UAE entity called Aqua1 Foundation declared a $100 million purchase of WLFI tokens, the largest known transaction of its kind. Analysis shows the top 50 token-holder wallets tied to World Liberty held more than $804 million, with foreign investors dominant.

World Liberty’s website describes its own offering as a “crypto-banking alternative,” though it has yet to deliver on such promises. Meanwhile, meme coins like $TRUMP generated $336 million in sales, highlighting how speculation and branding can drive value. The family reportedly receives 75% of token-sale revenue, while the venture markets its ties to the president and his network.

Policy Linkage and Governance Risks

The crypto ventures coincide with a broader easing of U.S. digital-asset regulation by the Trump administration, raising potential conflict-of-interest concerns. Since the president retains financial benefits from his businesses via a trust, the alignment between policy roles and private gain presents ethical red flags for regulators and watchdogs.

One key risk is that token-holders may have under-disclosed links to foreign capital or politically exposed persons. Meanwhile, investors reportedly saw the Trump-brand token sales as a way to gain indirect influence or access – although no formal quid-pro-quo evidence has emerged. Ethics analysts say the mismatch between regulatory oversight and token-sale marketing raises questions about transparency and enforcement.

Telegram’s CEO Unveils Cocoon AI-Blockchain Network on TON

Telegram announced its new “Cocoon” network, powered by AI and the TON blockchain, which lets GPU owners earn tokens and gives developers low-cost AI access while prioritising privacy.

Telegram founder Pavel Durov presents has unveiled Cocoon (Confidential Compute Open Network), a new decentralized platform that merges artificial intelligence compute power with blockchain infrastructure. Built on the TON blockchain, Cocoon will launch in November 2025, allowing GPU owners to contribute processing power and earn tokens while enabling developers to deploy AI models at lower cost.

The project is part of Telegram’s broader vision to integrate AI capabilities and financial utilities directly into its massive messaging ecosystem, which serves more than one billion monthly users. Telegram will also be among the first adopters, using Cocoon to enhance its suite of mini-apps and in-app bots.

AI, Blockchain, and the Future of Compute

Cocoon marks Telegram’s next step toward building an AI-driven digital infrastructure that unites social, financial and computational layers. The network’s decentralized model aims to challenge centralized cloud providers by offering competitive pricing, robust data privacy and greater transparency for AI workloads.

For GPU owners, Cocoon creates a new income stream: users can rent out computing capacity to AI developers and receive TON tokens in exchange. Developers gain access to an on-chain compute marketplace where they can process models securely without exposing proprietary data to third parties.

This launch positions Telegram at the crossroads of AI, blockchain and social media, signaling a major push to become a foundational player in the Web3 and AI-compute landscape.

Institutional Impact and Future Outlook

Industry analysts view Cocoon as an ambitious attempt to decentralize compute infrastructure and reshape how AI applications are built and monetized. By integrating blockchain incentives with real AI workloads, Telegram could open the door to tokenized computing marketplaces and community-driven data processing.

Still, execution risks remain. Telegram must build a large and reliable network of GPU providers, ensure TON’s scalability, maintain developer adoption and navigate compliance issues around tokenized rewards. Success will depend on whether the platform can deliver efficient, secure compute at scale while preserving user privacy.

Key developments to watch include the network’s initial GPU host participation, early developer adoption, AI workload volume, and Telegram’s own integration timeline. If successful, Cocoon could redefine the intersection of decentralized infrastructure, AI services and social-media engagement.

Nvidia Becomes World’s First $5 Trillion Company as AI Demand Surges

Nvidia has officially become the first company in history to reach a $5 trillion market capitalization, cementing its dominance in the AI era and setting a new benchmark for global technology valuation.

Nvidia (NVDA) has officially become the first company in the world to reach a $5 trillion market capitalization, solidifying its position as the undisputed leader of the artificial intelligence revolution.

Shares of the chipmaker surged more than 5% in early trading Wednesday, climbing to $211.30 at 9:31 a.m. ET, as investors reacted to accelerating demand for Nvidia’s latest AI processors and data-center platforms. The rally extended Nvidia’s year-to-date gains to over 85%, adding roughly $1 trillion in value in less than three months.

The achievement marks a defining moment in market history – the first time a publicly traded company has crossed the $5 trillion threshold, placing Nvidia ahead of Apple, Microsoft, and every other global corporate titan.

AI and Data-Center Dominance Power Growth

Nvidia’s rapid ascent has been fueled by explosive demand for its AI and machine learning chips, particularly the Blackwell GPU architecture, which is being adopted by leading data centers, cloud providers, and enterprise clients worldwide.

The company’s data-center division, which now accounts for more than 80% of total revenue, continues to post record-breaking quarters, with shipments of its AI accelerators outpacing production capacity across Asia and the U.S.

“Nvidia isn’t just selling chips – it’s selling the infrastructure for the next computing era,” said one Wall Street strategist. “Every hyperscaler, every AI lab, and nearly every Fortune 500 company wants a piece of Nvidia’s platform.”

Redefining Market Leadership

The milestone also reflects how profoundly AI investment has reshaped global markets. Nvidia’s $5 trillion valuation now exceeds the combined market capitalization of Tesla, Meta, and Amazon, and accounts for nearly 8% of the entire S&P 500.

The company’s growth trajectory has outpaced even the most optimistic forecasts from analysts, with consensus price targets already being revised upward. Investors now see Nvidia not just as a chipmaker, but as a foundational player in AI infrastructure, software, and systems integration.

Despite concerns about overvaluation and potential supply bottlenecks, Nvidia’s dominance in AI computing – coupled with rising adoption across industries from healthcare to defense – continues to sustain investor confidence.

As CEO Jensen Huang often describes it, Nvidia is “building the world’s AI factories,” a statement that now carries more literal truth than ever.

With its $5 trillion milestone, Nvidia has redefined what’s possible in technology markets – and set a new high bar for the global economy’s AI future.

Gold Rally Faces Pressure as Asia Challenges Central-Bank Buying Trend

Gold prices remain elevated after a robust run this year, yet officials at the Bangko Sentral ng Pilipinas (BSP) say their own heavy holdings may justify profit-taking, even as global central-bank buying supports the metal.

Gold’s stellar performance this year briefly topping $4,380 an ounce – continues to be fuelled by global uncertainty and central-bank accumulation. Yet in a surprising twist, a senior official at the Filipino central bank has suggested the country’s own bullion holdings may now be excessive. That candid comment comes amid record prices and adds a layer of complexity to the gold narrative.

The Bangko Sentral ng Pilipinas holds gold equivalent to roughly 13% of its $109 billion in reserves above levels typical for regional peers. Former governor and current Monetary Board member Benjamin Diokno noted this ratio could ideally sit around 8–12%, and questioned the timing of a potential sell-down: “What will happen if the price goes down?”

Central Bank Demand and Shifting Sentiment

Gold’s rally has been underpinned by several factors: strong central-bank purchases, safe-haven demand amid global risks and a weak U.S. dollar. Emerging-market banks in particular have shifted toward gold to diversify away from dollar-denominated assets.

That backdrop had seemed unassailable until recent commentary from parts of the Asian central-bank community. The suggestion that gold holdings may be “over-allocated” highlights important questions about future demand and reserve-management strategy. One bank noted that while gold remains a hedge, it is “a very poor investment” in strictly financial-return terms.

Market Outlook and Price Scenarios

Even with near-term momentum intact, signals of a shift in official holdings pose risks for gold’s trajectory. According to one forecast, the rally could unwind substantially—projecting bullion at $3,500 an ounce by end-2026 if central-bank appetite fades. At the same time, other analysis points to a possible move toward $4,900 an ounce as institutional interest remains robust.

Key indicators to watch include changes in gold-reserve allocations by central banks, note-taking of any major sell-downs, and bullion flows into regulated funds. Retail participation and speculative positioning will also amplify moves. On the flip side, if geopolitical risk rises or real yields fall further, gold could reclaim upward momentum quickly.

As previously covered, the gold market now sits at the intersection of investment, reserve policy and geopolitics. The uneasy tension between institutional signals and speculative fervour suggests the current phase may be one of cautious recalibration rather than sustained euphoria.

U.S. Stocks Hit Record Highs Despite Broad Market Declines

The S&P 500 reached a new all-time high above 6,900 even as nearly 80% of its components fell, with Apple, Nvidia and Microsoft alone driving the rally ahead of the Fed’s rate decision.

U.S. stocks extended their rally on Tuesday, with the S&P 500 surpassing 6,900 for the first time, even as most companies in the index ended lower. The paradox reflects an increasingly concentrated market, where a handful of technology giants continue to outweigh broader weakness ahead of the Federal Reserve’s rate decision.

According to market data, 398 of the 500 S&P 500 constituents closed in negative territory, but the sharp rise in Apple (AAPL), Nvidia (NVDA) and Microsoft (MSFT) was enough to push the benchmark to new records. On social media, traders joked that “the entire U.S. economy is just seven companies passing trillions back and forth.”

Despite the narrow breadth, the Dow Jones Industrial Average gained 0.3%, the S&P 500 rose 0.2%, and the Nasdaq Composite climbed 0.8%, supported by strength in AI-linked stocks and expectations of an upcoming Fed rate cut. Analysts said the advance reflects optimism about earnings resilience and monetary easing rather than a broad-based recovery.

Why the Market Keeps Rising

Three key factors are sustaining the rally:

- Tech dominance: Gains in mega-cap AI and semiconductor stocks continue to overshadow declines across other sectors.

- Earnings momentum: Roughly one-third of S&P 500 companies have reported, with about 83% beating analyst estimates.

- Rate expectations: Investors anticipate the Fed will deliver a 0.25-point rate cut soon, supporting growth and liquidity sentiment.

The result is a market that looks strong on paper but shows underlying fragility.

Investor Outlook and Key Risks

The disconnect between index performance and market breadth raises concern about sustainability. If interest-rate expectations shift or inflation data surprises higher, the rally could lose momentum quickly. Concentration risk also looms large: with trillion-dollar tech firms driving nearly all the gains, any earnings disappointment could ripple across indexes.

Traders are watching for the Fed’s tone at its upcoming policy meeting, as well as corporate guidance during the next earnings cycle. The balance between monetary easing, profit growth and market concentration will define whether the latest records mark the start of a new bull leg or the peak of an overheated rally.

Visa to Support Four Stablecoins Across Four Blockchains

Payments giant Visa announced it will begin supporting four different stablecoins operating on four unique blockchains, expanding its crypto-asset infrastructure amid growing institutional demand.

Global payment network Visa is set to expand its stablecoin support by enabling four stablecoins on four distinct blockchain networks. The announcement comes as part of Visa’s broader strategy to deepen its digital-asset capabilities and streamline crypto-to-fiat conversions.

CEO Ryan McInerney disclosed that the company will support two fiat-pegged currencies represented via these stablecoins, which can be converted into more than 25 traditional fiat currencies. Although the exact stablecoins and blockchains were not specified, Visa already supports assets like USDC and PYUSD on chains such as Ethereum and Solana.

New Payments Infrastructure in Motion

Visa noted that since 2020 it has facilitated more than $140 billion in stablecoin and crypto flows. Spending on Visa cards linked to stablecoins has quadrupled compared to the same quarter last year, and the company’s stablecoin settlement volume now exceeds a $2.5 billion annualised run-rate.

By supporting stablecoins across multiple chains, Visa is positioning itself to offer banks and financial institutions tools for minting and burning tokens via its tokenised-asset platform. It also plans to enhance its Visa Direct services to handle pre-funded stablecoin transfers for cross-border money movement.

Institutional Impact and Future Outlook

For financial institutions, Visa’s expanded stablecoin support represents a step toward incorporating digital-asset rails into mainstream payments and settlement infrastructure. This may open new paths for banks, fintechs and merchants to participate in on-chain value flows without building their own network from scratch.

Still, significant risks remain. The success of the initiative depends on regulatory clarity, token-liquidity management, integration across blockchains and whether merchants adopt stablecoins at scale. Market participants will watch for early roll-outs, merchant acceptance rates, network-transaction metrics and how Visa’s service layer evolves.

As previously covered, stablecoins are shifting from experimental tokens to foundational components of the digital-payments architecture and Visa’s new support may mark a key acceleration point.

Circle Launches Arc Testnet with BlackRock, Goldman Sachs and Visa

Circle Internet Group launched its public testnet for the Arc Layer-1 blockchain – a move backed by over 100 major institutions, including BlackRock, Mastercard, Goldman Sachs and Visa.

Circle has opened the public testnet for Arc, a new open-source Layer-1 blockchain designed to serve as an “economic operating system” for the internet. The rollout features participation from more than 100 organizations, including major financial, payment- and technology-firms.

Arc is built with features such as predictable dollar-based fees, sub-second transaction finality and optional privacy controls. It integrates with Circle’s existing platform and aims to support on-chain applications across payments, lending, capital markets and FX.

Why the Testnet Matters

The launch signals Circle’s ambition to extend its reach beyond stable-coin issuance and into infrastructure that underpins institutional finance. Backing from firms like BlackRock, Goldman Sachs and Visa validates the project’s potential to bridge traditional finance with blockchain.

By positioning Arc as a backbone for tokenized assets, global settlement and programmable money, Circle aims to transition from crypto issuer to infrastructure provider. The design emphasises enterprise-grade reliability, compliance and global reach across Africa, Asia, Europe and the Americas.

Institutional Impact and Future Outlook

For financial firms, Arc presents an opportunity to test blockchain-native operations at scale – whether for stable-coin-based settlement, cross-border payments or programmable FX workflows. If successful, it may alter how institutions access global infrastructure and move value.

However, major risks remain. Building trust among established institutions, satisfying regulatory expectations, and delivering infrastructure that competes with existing systems are all formidable tasks. Whether Arc can move from testnet to live production without stalling will be closely observed.

Key indicators include: which institutions deploy live use-cases on Arc, how many stable-coins or tokenised assets are launched on the network, what transaction volumes emerge, and how regulators respond to the intersection of programmed finance and traditional markets.

As previously covered, blockchain is evolving from experimental to foundational infrastructure – Circle’s Arc may mark a turning point if it can deliver on its promise at institutional scale.

PayPal Stock Jumps 11% on New Wallet Partnership with OpenAI

Shares of PayPal surged 11% after the company announced it will integrate its digital wallet into OpenAI’s ChatGPT platform, enabling users to complete purchases directly within the chatbot.

PayPal shares rose approximately 11% after the company announced a strategic partnership with OpenAI to integrate its digital wallet directly into the ChatGPT platform. The move positions PayPal to become a primary payments option for users shopping through ChatGPT and represents a significant leap into AI-powered e-commerce.

Under the collaboration, ChatGPT users will be able to link their PayPal accounts and complete purchases without leaving the chatbot interface. The integration taps into PayPal’s extensive merchant network and OpenAI’s growing consumer reach, aiming to streamline checkout experiences across platforms such as Shopify, Etsy and Walmart.

AI Integration Revives PayPal’s Growth Strategy

For PayPal, the agreement marks a decisive effort to stay relevant amid the rise of AI and changing retail habits. The company has faced pressure this year, with its stock declining year-to-date and growth in core payment volumes slowing. The deal with OpenAI gives PayPal fresh momentum by embedding its wallet into a conversational commerce environment and locking in future relevance.

The initiative also underscores a broader trend: AI assistants evolving from search tools to transactional platforms. By weaving PayPal’s wallet into ChatGPT, both companies aim to capitalise on a “chat-to-checkout” model, giving PayPal early access to a high-volume consumer interface. The origins of the Agentic Commerce Protocol – emerging from the integration – bring infrastructure-layer gains for PayPal and competitive advantage in the evolving payments stack.

Investor Outlook and Key Challenges

For investors, the rally suggests confidence that PayPal can adapt its business model and tap into high-margin e-commerce flows. If the integration succeeds, PayPal may benefit from increased wallet usage, higher transaction volumes and deeper merchant loyalty.

However, execution risks are significant. Adoption will depend on how seamlessly the wallet works inside ChatGPT, the speed of merchant integration, user experience and regulatory scrutiny of AI-commerce payments. PayPal must also prove that this goes beyond hype and translates into measurable revenue growth and margin expansion.

Watch for key indicators including merchant enrolment rates, average transaction values through ChatGPT, wallet-balance growth and incremental fees. Also important: how the broader AI-payments ecosystem evolves and how quickly rivals respond.

As previously covered, digital-wallet firms are under mounting pressure to show innovation and relevance as AI changes how goods are discovered and bought. PayPal’s pivot into AI commerce may define who wins the next chapter of payments.

Apple Reaches $4 Trillion Market Cap, Joining Nvidia and Microsoft in AI-Led Tech Rally

Apple became the latest company to surpass $4 trillion in market value, joining Nvidia and Microsoft as investors reward AI innovation and stronger-than-expected iPhone 17 sales.

Apple (AAPL) has become the latest company to reach the $4 trillion market capitalization milestone, joining Nvidia (NVDA) and Microsoft (MSFT) as investor enthusiasm around artificial intelligence and hardware innovation continues to propel the world’s largest technology firms to record highs.

Apple’s shares rose this week after Counterpoint Research reported that its new iPhone 17 lineup outperformed last year’s iPhone 16 in early sales, particularly in the United States and China. According to the data, iPhone sales jumped 14% year-over-year during the first 10 days of availability, with consumers showing strong demand for both the base iPhone 17 and iPhone 17 Pro models.

The newly introduced iPhone Air is also outselling the iPhone Plus, which it replaced this year – a sign that Apple’s product refresh and pricing strategy are resonating in a crowded smartphone market.

Cooling Lead Times, but Strong Core Demand

Despite the initial surge, some analysts note signs of a modest slowdown. In a recent research note, Jefferies analyst Edison Lee said lead times – the waiting period between ordering and delivery – have shortened across several major markets, including the U.S., Germany, and China.

“For [iPhone 17 Pro], the U.S. now has zero lead time, meaning three out of six markets we track have no wait,” Lee wrote. “For [iPhone Pro Max], delivery times have also fallen further, while Germany and the U.K. remain at zero.”

Even with moderating lead times, Apple’s smartphone business remains its financial cornerstone, generating $201.2 billion of its $391 billion in total revenue in 2024. Its Services segment, including iCloud, Apple Music, and App Store operations, brought in $96.2 billion, reflecting a growing diversification beyond hardware.

AI Integration and Market Leadership

Analysts credit Apple’s expanding AI ecosystem – including on-device intelligence across the iPhone 17 series and its Vision Pro platform – as a key driver behind renewed investor optimism. The company’s ability to merge AI seamlessly into consumer products has reinforced its competitive edge against both hardware rivals and software-centric peers.

Meanwhile, Nvidia and Microsoft, which previously crossed the $4 trillion threshold, continue to dominate AI infrastructure and enterprise computing. Nvidia’s chip demand remains unprecedented, while Microsoft’s deep integration of OpenAI technology into its cloud and productivity platforms is reshaping enterprise software.

Together, Apple, Microsoft, and Nvidia now represent over 20% of the S&P 500’s total market capitalization, symbolizing the deep concentration of global investor confidence in AI-powered growth.

While analysts warn that valuations could be tested by economic headwinds or regulatory scrutiny, Apple’s strong balance sheet, brand loyalty, and cross-platform AI strategy keep it well positioned to sustain momentum through 2026.

For now, the world’s most valuable public company has reaffirmed its dominance – and placed itself firmly at the center of the AI-driven era in technology.

Ro Khanna Proposes Ban on Crypto Trading for Trump Family and Federal Officials

Democratic Representative Ro Khanna is introducing legislation to bar the president, congressional members and their families from trading cryptocurrencies, citing mounting concerns about conflicts of interest and influence from the crypto industry.

Democratic Representative Ro Khanna of California announced that he will introduce a resolution aimed at prohibiting the U.S. president, members of Congress and their family members from trading cryptocurrencies. The move comes amid heightened scrutiny of the crypto sector’s influence in Washington and fears of potential conflicts of interest involving senior officials.

Khanna said the legislation is a direct response to what he views as “unprecedented” overlap between political power and crypto-asset activity. He cited recent high-profile developments involving the crypto industry and federal officials as reason enough to draw stricter boundaries.

Why This Proposal Matters

The proposed ban underscores how digital assets are reshaping government ethics discussions. Khanna pointed out that while digital-asset markets have grown rapidly, regulatory oversight and transparency remain weak, especially when public officials possess personal stakes. The bill reflects rising concern that officials’ crypto holdings could influence policy decisions or undermine public trust.

By focusing on the president and members of Congress including their relatives Khanna’s legislation broadens the scope of ethics reform beyond traditional stock trading to cover digital-asset investments. The proposal signals a recognition in Washington that cryptocurrencies deserve the same scrutiny as equities when it comes to insider privilege and political influence.

Implications, Risks & What to Watch

For the crypto industry, the introduction of this bill highlights increasing regulatory risks tied to political-finance linkages. If passed, the legislation could force exchange disclosures of trades made by sensitive individuals or impose restrictions on participation by high-level officials altogether.

Critics may argue the proposal infringes on personal investment rights or overemphasises political-asset boundaries. Others warn that defining “family members” or “relations” and enforcing these rules could create practical complications. The legislative path may also encounter resistance from those who view crypto as a personal asset class rather than public interest risk.

Observers will closely monitor how Khanna builds support for the resolution, whether bipartisan backing emerges and how regulatory bodies respond. Date of introduction, committee hearings and any amendments to scope or enforcement will be key signs of momentum.

As previously covered, the evolving role of cryptocurrencies in public-policy debates reflects a broader shift: digital assets are no longer just investment instruments they’re now part of the governance conversation.