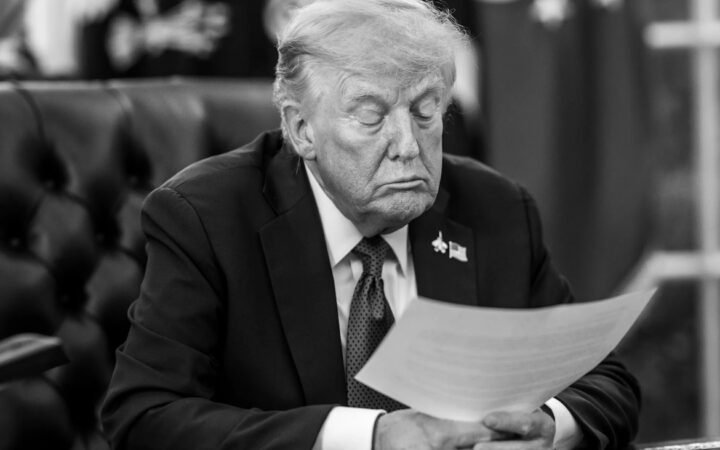

President Trump has signed into law an increase in the state and local tax (SALT) deduction cap, lifting it from $10,000 to $40,000 for many taxpayers. The measure is aimed at easing the burden for households in high-tax states while phasing out benefits for top earners above $500,000 in income.

The policy change gives new relief to millions of itemizers. But according to a Redfin analysis, the benefit varies sharply by state, underscoring how unevenly the expanded deduction will play out across the country.

Where the Biggest and Smallest Savings Are

Itemizers in certain states could see a far greater windfall from the higher cap. Redfin’s data shows the five states with the largest median savings from the new law are New York at about $7,092; California at $3,995; New Jersey at $3,897; Massachusetts at $3,835; and Connecticut at $3,133.

By contrast, some states will see only modest gains. The smallest median savings are expected in South Dakota at $1,033; Alaska at $1,052; Nevada at $1,090; Tennessee at $1,097; and New Hampshire at $1,101. This disparity reflects differences in property taxes, state income taxes and how many residents itemize deductions.

Tax experts note the new cap is still subject to income thresholds, meaning many higher-earning households won’t capture the full benefit. Phaseouts begin at $500,000 and can drop back toward the old cap at $600,000 and above.

Political Context and Economic Impact

The uneven pattern of savings highlights the political dimension of the change. Republicans from high-tax states have long pressed to raise the SALT cap, arguing their constituents were unfairly penalized. By delivering a larger deduction in places like New York and California, Trump may gain goodwill in areas traditionally skeptical of his tax policies.

Critics, however, argue that raising the cap disproportionately helps wealthier homeowners and could incentivize states to raise taxes. They also warn of a hit to federal revenue.

For now, the law gives itemizers in high-tax states a substantial new write-off. How much that affects housing markets, migration trends and state budgets will become clearer as taxpayers adjust to the new rules.